Introduction

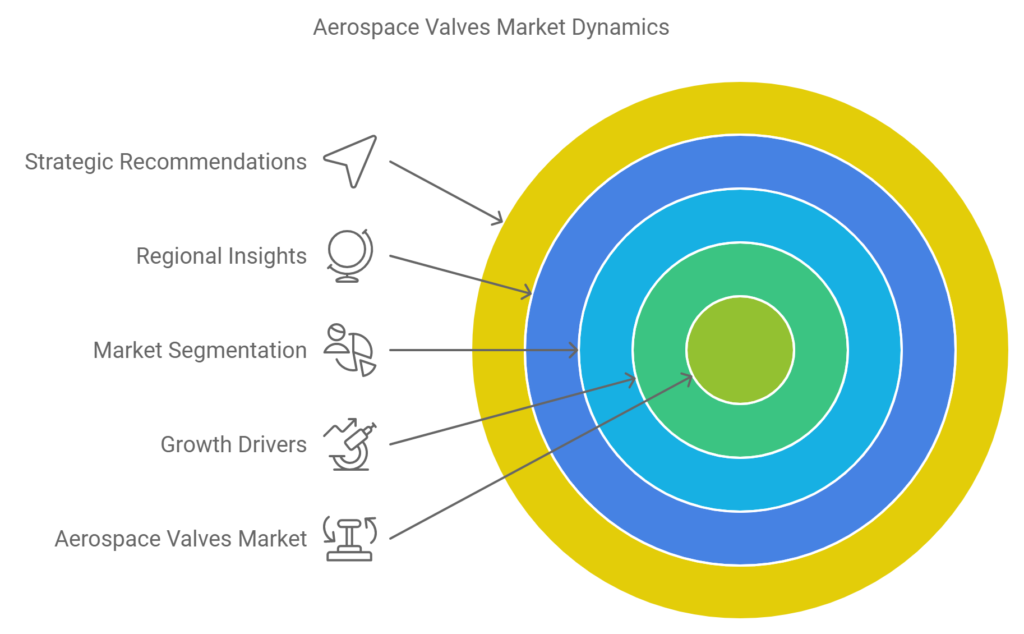

The aerospace valves market is projected to experience substantial growth, with forecasts suggesting it will reach $18.5 billion by 2033, propelled by a steady CAGR of 4.2% from 2024 to 2033. This expansion, which follows a valuation of $12.3 billion in 2023, underscores a rapidly evolving market influenced by advancements in valve technologies, increased defense spending, and rising demand for fuel-efficient aircraft. In this comprehensive analysis, we explore the key growth drivers, market segmentation, regional insights, challenges, and emerging trends shaping the future of the aerospace valves industry.

Market Growth Overview

The aerospace valves market has been witnessing consistent growth, primarily driven by the need for more sophisticated and reliable valve technologies in various aircraft systems. The industry is expected to grow from $12.3 billion in 2023 to $18.5 billion by 2033, marking a notable rise over a decade. The market’s steady CAGR of 4.2% can be attributed to several factors, including increased air travel, heightened military expenditures, and the push for greener aviation through fuel efficiency and sustainable technologies.

Key Statistics Illustrating Market Expansion

- 2023 Market Size: $12.3 billion

- Forecasted 2033 Market Size: $18.5 billion

- CAGR (2024-2033): 4.2%

The steady growth trajectory reflects a broader trend of modernization in the aerospace industry, with a strong focus on technological advancements and material innovations.

Key Drivers Fueling the Aerospace Valves Market Expansion

Increased Demand for Fuel-Efficient Aircraft

The aerospace industry is experiencing a significant shift toward sustainability, with airlines and manufacturers prioritizing fuel-efficient aircraft to reduce carbon emissions. Valves play a crucial role in various aircraft systems, such as fuel management, hydraulics, and pneumatics, which are integral to enhancing fuel efficiency.

- Lightweight valve designs help reduce aircraft weight, contributing to overall fuel savings.

- Optimized valve technologies ensure precise control over fuel flow and distribution, minimizing wastage.

The emphasis on sustainable aviation is further bolstered by international regulatory bodies and governments setting stringent emission targets. As a result, the adoption of advanced aerospace valves is expected to grow significantly.

Technological Advancements in Valve Design and Materials

Technological innovations are at the heart of the aerospace valves market’s growth. The development of smart valves with integrated sensors allows for real-time monitoring of valve performance, ensuring optimal functionality and safety.

- Smart valves equipped with Internet of Things (IoT) technology enable predictive maintenance by alerting operators to potential issues before they escalate, thereby reducing downtime.

- New materials, such as titanium and advanced composites, are being utilized in valve manufacturing to enhance durability while reducing weight.

The focus on material innovations aims to meet the demands for higher performance standards in aerospace applications, where safety and reliability are paramount.

Growing Defense Budgets and Military Spending

Global military expenditures are on the rise, driving demand for defense aircraft, unmanned aerial vehicles (UAVs), and other military systems that incorporate high-performance valves.

- Increased spending by countries such as the United States, China, and India is creating lucrative opportunities in the defense aerospace sector.

- Aerospace valves used in military applications must meet stringent requirements for high-pressure systems, temperature extremes, and vibration resistance.

The growing need for combat aircraft, helicopters, and surveillance drones further contributes to the demand for advanced valve solutions in defense applications.

In-Depth Market Segmentation

By Valve Type

The aerospace valves market can be segmented into several key types, each serving distinct functions in aircraft systems. These include:

- Butterfly Valves: Commonly used in fuel and fluid management systems due to their lightweight design and compact size.

- Ball Valves: Valued for their ability to provide tight sealing and are frequently used in hydraulic systems.

- Rotary Valves: Often found in engine control applications, where they regulate the flow of air and fuel mixtures.

- Other Types: Include check valves, gate valves, and needle valves, each with specialized uses in aerospace applications.

Understanding the specific applications and advantages of each valve type is essential for stakeholders to identify the right solutions for different aircraft systems.

By Material

Material selection plays a critical role in determining a valve’s performance, weight, and cost. The market segments valve materials into:

- Steel: Offers excellent strength and durability but adds weight, making it suitable for non-weight-sensitive applications.

- Titanium: Known for its high strength-to-weight ratio and corrosion resistance, ideal for critical aerospace applications.

- Aluminum: Lightweight and relatively low-cost, used in situations where weight reduction is a primary concern.

- Composites and Alloys: Emerging materials aimed at combining the benefits of multiple substances to enhance performance and reliability.

By Aircraft Type

The demand for aerospace valves varies across different aircraft categories, including:

- Commercial Aircraft: Comprising the largest market segment due to the expanding global fleet and the need for frequent maintenance and replacements.

- General Aviation Aircraft: Covers small planes used for personal or business travel; demand is driven by the increasing popularity of private flying.

- Business Aircraft: Features high-end, technologically advanced valve solutions tailored to meet the unique requirements of private jets.

- Military Aircraft: Includes a wide array of aircraft types, from fighters to transport planes, where reliability and performance under extreme conditions are crucial.

Regional Insights: Market Performance Across Geographies

North America

North America is expected to remain the largest market for aerospace valves, driven by its robust aerospace manufacturing sector and significant military expenditure.

- The United States leads the market, with its large defense budget and concentration of key aerospace companies.

- Canada also contributes to regional growth through its manufacturing and maintenance services for both commercial and military aircraft.

Asia-Pacific

The Asia-Pacific aerospace valves market is poised for rapid growth, with countries like China and Japan leading the way.

- Increased air traffic, expanding airline fleets, and technological advancements in aircraft manufacturing are key drivers.

- India’s growing defense budget and ambitions to expand its domestic aerospace industry further support market growth.

Europe and Other Regions

- Europe: Home to major aerospace players like Airbus, Rolls-Royce, and Safran, Europe remains a significant market, with a focus on innovation and sustainable aviation.

- Latin America and the Middle East: Emerging markets where growth is driven by the expansion of regional carriers and rising defense budgets.

Market Challenges: Navigating Barriers to Growth

High Manufacturing Costs

The production of advanced aerospace valves involves substantial investment in R&D, high-quality materials, and precision manufacturing techniques.

- These factors contribute to higher costs, which can limit adoption, especially among budget-constrained operators.

- Economies of scale and advancements in manufacturing technology may help reduce costs over time.

Regulatory Compliance

The aerospace industry is subject to stringent safety and performance standards, with certification processes that can be time-consuming and expensive.

- Compliance with regulations set by bodies such as the FAA (Federal Aviation Administration) and EASA (European Union Aviation Safety Agency) is mandatory.

- Navigating regulatory hurdles can be challenging, but ensuring compliance is essential for market success.

Key Trends Shaping the Future of the Aerospace Valves Market

Adoption of Smart Valves

The integration of digital technologies into valve systems, such as smart valves with IoT connectivity, is transforming the industry.

- Predictive maintenance capabilities reduce downtime and enhance safety by detecting issues early.

- Data analytics enables more informed decision-making regarding maintenance schedules and valve replacements.

Lightweight and Durable Materials

The push for fuel-efficient aircraft has spurred the development of new materials that offer strength without added weight.

- Composite materials and titanium alloys are being used to manufacture valves that meet the demand for lightweight solutions.

- These materials contribute to the overall performance enhancement of aircraft systems.

Strategic Recommendations for Industry Players

Leveraging Technological Advancements

Companies should prioritize R&D investments to stay at the forefront of valve technology innovations.

- Developing smart valve technologies can provide a competitive edge in the market.

- Collaborating with aerospace manufacturers to integrate new valve technologies into aircraft designs can open new opportunities.

Expanding Market Presence in High-Growth Regions

Asia-Pacific and other emerging markets present attractive growth opportunities due to rising air traffic and defense budgets.

- Establishing local partnerships and investing in regional facilities can help tap into these markets.

- Understanding regional regulations and standards can facilitate easier market entry.

Cost Optimization and Regulatory Strategy

- Investing in automation and advanced manufacturing techniques can help reduce production costs.

- Companies should work closely with regulatory bodies to streamline certification processes and ensure compliance.

Conclusion

The aerospace valves market is set for a period of robust growth, driven by increasing demand for fuel-efficient aircraft, technological innovations, and rising defense spending. However, navigating challenges such as manufacturing costs and regulatory compliance will be essential for companies to capitalize on the emerging opportunities. By focusing on technology development, expanding in high-growth regions, and optimizing costs, industry players can position themselves for long-term success in this evolving market.

Call to Action

If you’re a stakeholder or an enthusiast in the aerospace industry, share your thoughts and insights on the future of aerospace valves in the comments below. How do you see new technologies influencing the market? What strategies should companies adopt to stay ahead of the curve? Join the conversation and stay updated with the latest trends in aerospace technology.

Citations:

[2] https://www.futuremarketinsights.com/reports/aerospace-valves-market

[3] https://www.alliedmarketresearch.com/aerospace-valves-market-A323755

[4] https://www.alliedmarketresearch.com/aerospace-pneumatic-valves-market-A14654

[5] https://www.alliedmarketresearch.com/reports-store/aerospace-and-defence

[6] https://www.alliedmarketresearch.com/press-release/actuators-and-valves-market.html

[7] https://www.fatposglobal.com/reports/aerospace-valves-market-1679

[8] https://www.alliedmarketresearch.com/press-release/industrial-valves-market.html

Latest Posts:

- Tapping into the $6.94 Billion Neuro-Endocrine Tumor Market: Is This the Next Groundbreaking Investment Opportunity?

- Future Market Value: $7.8 Billion by 2030 | Is the Surgical Sutures Market Set for Explosive Growth?

- The Promising Future of the Global Two-Wheeler Catalytic Converter Market: Trends and Projections for 2024-2028

- $4.5 Billion Potential: Is Insolvency Software Your Next Big Investment?

- $3.76 Billion Opportunity: Uncovering the Growth Drivers of the Global Military Helmet Market